Economics - October 2023

Economics – October 2023

The core principle of Bidenomics is to provide support to the lower and middle classes, with the idea that corporate profits and individuals with significant wealth should contribute to funding these initiatives, rather than solely relying on the government or the taxpayers.

His campaign ads laud the passage of COVID emergency funds, the bipartisan infrastructure law, the inflation reduction act and funding the semiconductor manufacturing.

See here all the progress as touted by

Fact Check, financed and led by the Anneberg Foundation, which is also a NPR donor?

(Annenberg Foundation). If you look at the details, it can all be reported in the brightest possible picture, compare

the wages increase

here,

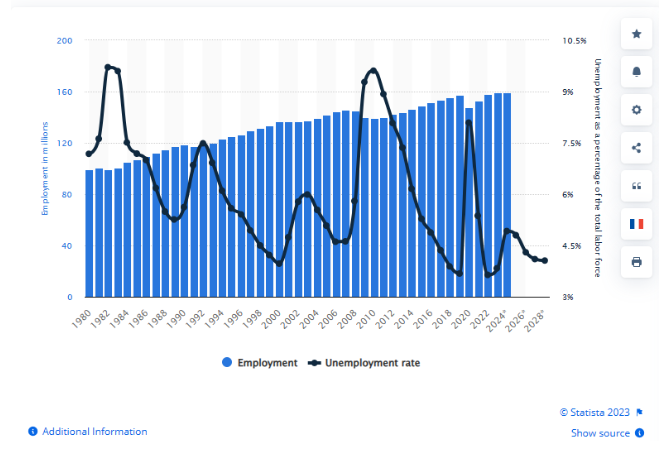

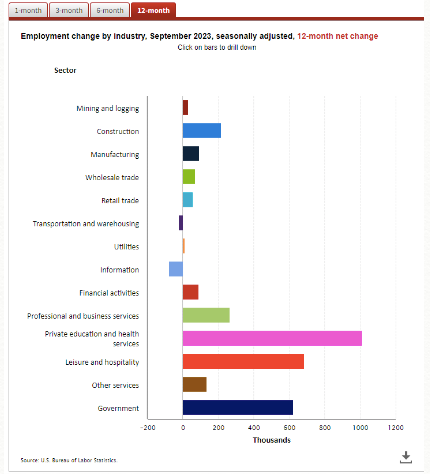

the 13 plus million new jobs may have come as a result of the end of Covid, or according to Statista 2019 was 157,53 and 2023 159,38 million, that is about 2 million, of which the good paying Manufacturing jobs are not leading the charge but

Service, Healthcare and Government?

And here the other sides of the Coin,

The impetus for these massive deficits is federal government spending, which tipped the scales at $6.1 trillion last year. Government receipts, meanwhile, were $4.4 trillion, woefully short of the $5 trillion previously forecasted. A slowing economy and counterproductive tax increases were key drivers behind the $457 billion drop in receipts from the prior fiscal year.

Yet, even these reduced revenues would have resulted in a balanced budget if President Biden had simply allowed spending to return to its pre-pandemic level. Instead, Treasury outlays are up 38 percent today compared to pre-pandemic times.

The number of Americans suffering from hunger and food insecurity exploded by more than 10 million under President Joe Biden, according to a U.S. Agriculture Department report this week that provided fresh evidence of inflation‘s impact of a basic staple of life.

The report found 44.2 million Americans were living in food-insecure households in 2022, compared to 33.8 million the year before.

And the profits go to the War (Defense) Industry and the big Corporations, all of which wanted a big Government, just wondering who ends up paying the Bills?

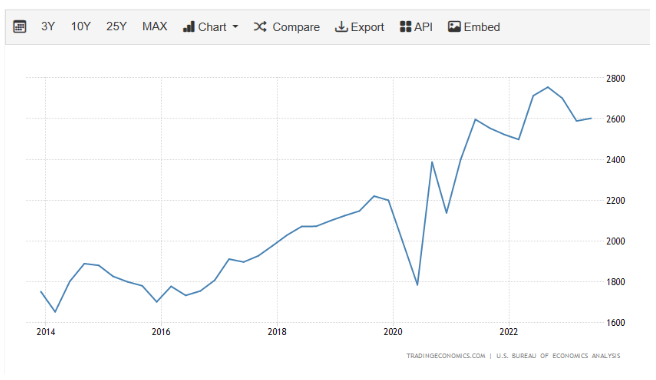

Corporate profits in the United States increased 0.5 percent to USD 2.60 trillion in the second quarter of 2023, less than preliminary estimates of a 1.6 percent rise and following a 4.1 percent fall in the previous period. Net cash flow with inventory valuation adjustment, the internal funds available to corporations for investment, rose 1 percent to USD 3.20 trillion, and net dividends went up 0.8 percent to USD 1.86 trillion. Meanwhile, undistributed profits fell 0.3 percent to USD 0.75 trillion. source: U.S. Bureau of Economics Analysis

The labor force level is the number of people who are either working or actively looking for work. On the other hand, the labor force participation rate is the percentage of the civilian noninstitutional population that is in the labor force.

Here a bit more on

labor participation rate and Labor shortage, and we all wonder if immigration will close the Gap, with aging Boomers leaving. Perhaps the next bill will be educational, for all the jobs needed.

Wonder why President Bidens approval on the Economy is not improving,

but this is how the Biden supporters see it, blame the others, sounds familiar. Money spent, no one can point the success to the Money spent, improving for the big guys? Note the references to Europe, it is a direct result of the Sanctions on Russia, and devastating for Europe, and the drive to Green and renewables, other than Meloni to which the same paper upon election branded her a Fascista and NAZI, the same as our President calls the Trumpers.

So all in all, the only ones that see success in Bidenomics are his base, which are the 2020 donor circle? The approval ratings below would have every CEO fired?

Yes, Biden’s approval rating in another Morning Consult survey is a dismal 40%. But that’s better than Canada’s Justin Trudeau (33%), the UK’s Rishi Sunak (28%), France’s Emmanuel Macron (26%), Germany’s Olaf Scholz (25%) or Japan’s Fumio Kishida (22%). The only leader of a G-7 country with better numbers than Biden is Italy’s Giorgia Meloni, at 44%. Not coincidentally, Meloni took office only about a year ago — mostly after the major inflationary episode of 2021-2022 had begun to improve.

This leads us easily to the Global stage, and bar the world is crazy enough to sacrifice the economy to democracy by War, in which situation no prediction will hold up, but then again perhaps the US will remain the global power, much like the approval ratings.

Here the latest from the

WEF, and the

Economist, but the

Credit Card debt, the Housing Market and Grocery cost, will certainly circle back to the Food Stamps, note under Obama it added 40 million recipients and they still voted for him. More on economics next Month, but the people feel confident living on debt, as much as the Government.

Americans’ total credit card balance is $1.031 trillion in the second quarter of 2023, according to the latest consumer debt data from the Federal Reserve Bank of New York. That’s up from the first quarter of 2023’s record number, leaving the balance the highest since the New York Fed began tracking in 1999.

This is the first time credit card debt has topped $1 trillion in this country. The $45 billion second-quarter increase comes on the heels of a first quarter in which the credit card debt level remained unchanged. That lack of movement was noteworthy since it bucked decades-long historical trends, marking the first time since 2001 in which credit card debt didn’t fall in the first quarter. In fact, the only times card debt didn’t fall in the first quarter of the year since the New York Fed report began were 2000 and 2001. Every year since, card debt fell at least a little bit — until this year. That lack of a decrease may not bode well for Americans’ credit card debt numbers for the rest of the year.

With this latest increase, credit card balances have risen by $175 billion since the fourth quarter of 2021. Americans’ credit card debt is $104 billion higher than the record set in the fourth quarter of 2019, when balances stood at $927 billion. However, thanks to still-rising interest rates, stubborn inflation and myriad other economic factors, credit card balances are likely only going to climb, at least in the near future.

These record balances are light years above the $478 billion seen more than 20 years ago in the first quarter of 1999.

Sign Up For Our Newsletter

We will get back to you as soon as possible

Please try again later